Shire Leasing is working with Bristol City Council to provide direct support to local businesses to upgrade eligible vehicles. This includes pre-Euro 6 Diesel and Pre-Euro 4 Petrol LGV’s, HGV’s, Coaches and Taxis that are regularly entering the centre of Bristol and have been identified as having a particularly negative impact on air quality through their tailpipe emissions. Businesses can benefit from a Grant towards the cost of an upgrade to a Compliant vehicle, and the option of subsidised Finance to help make the switch more affordable.

How to get started?

If you are interested in participating in the scheme, in the first instance, you should register your interest and discuss your circumstances with the Bristol Clean Air Zone team. You can learn how to do this by reading our Frequently Asked Questions (FAQ’s).

Completed Bristol basic eligibility assessment?

If you have already received your Basic Eligibility Letter from Bristol City Council and wish to apply for financial assistance, you can find out more about the business finance options we can offer and make an application further down this page.

Quick links

To make it easier and faster for you to find the information that you are looking for, you can click on the quick links to take you straight to the relevant section on the page. Alternatively, you can continue scrolling.

Five simple steps

Step 1

1. Contact Bristol City Council to complete initial eligibility checks.

Step 2

2. If eligible, complete an application.

Step 3

3. Receive a decision in as little as 8 working hours.

Step 4

4. If accepted, we will issue the Grant and/or Lease documentation for e-signature (or by post if more convenient).

Step 5

5. Begin your journey to a greener, cash-flow friendly future.

Upon completion of all relevant documentation, payments are made and the agreement begins.

Clean Air Zone financial assistance from a reliable funder

As experts in the UK SME marketplace, we have established ourselves as an experienced and reliable funder for vehicles, assets and almost anything else business related. Whether it’s a one-off car purchase, or a brand new commercial vehicle fleet, with over 30 years of business funding experience, Shire Leasing has the knowledge and expertise to help eligible businesses to invest in CAZ compliant vehicles.

In addition to administering your Grant, we can offer businesses interest-subsidised Hire Purchase and Finance Lease solutions. Our finance options can help businesses to improve cash flow, by spreading the cost of your vehicle.

Your Financial Support Explained

The amount of support that you are able to receive from the Council depends on the non-compliant vehicle that you are replacing.

Subject to passing initial checks, you will be given a ‘Basic Eligibility Letter’ (sometimes referred to as your BEL) by the Council. The BEL will explain the maximum financial support available to you.

There are two important numbers for you to be aware of being the total financial support and the maximum of this financial support that you are able to take as a Grant.

Example based on a Van:

Total Financial Support

Total Financial Support available on a new van | £6,000 |

The maximum value of which can be taken as a Grant which will be paid to the dealership directly | £4,500 |

The amount of the total financial support that can be taken as a Grant is calculated as a maximum of 35% of the net upgrade cost of your new vehicle. The net upgrade cost is the base price of the new vehicle minus the trade in of your old vehicle.

The balance (if any) between the Total Financial Support and the Grant can be taken towards the finance charges on a finance agreement.

Calculation of the Grant Available

So if we continue to use the same financial support in this example;

All numbers should be exclusive of VAT

New Van Base Price | £12,000 |

Minus Trade-In of Non-Compliant Van | £3,000 |

Net Upgrade Cost | £9,000 |

Minus Grant at 35% (35% of £9,000) | £3,150 |

Balance payable to the dealership | £5,850 |

These examples are subject to eligibility and where the Grant and Finance option is selected, also our affordability checks.

- Through accessing the subsidised finance option (Finance and Grant) subject to credit approval.

In this example, the customer is able to take the balance of financial support of £2,850 (Total Financial Support of £6,000 minus the Grant of £3,150) towards interest charges on a finance agreement or move forward with Grant Only support.

- As a cash transaction (Grant Only).

Please note that if a Grant Only option is taken the balance of £2,850 is forfeited.

Compare options to suit your business

Grant

Grant

You could receive a Grant of up to 35% of the net upgrade cost of your new vehicle, significantly reducing the final cost of an upgrade. Grants are capped for each vehicle type, as shown below.

The benefits:

Light Commercial Vehicles: Up to £4,500

Heavy Goods Vehicles: Up to £16,000

Hackney Cabs: Up to £4,000

Private Hire Vehicles: Up to £1,500

Coaches: Up to £16,000

These Grants can be used alongside the scheme’s subsidised finance, which we can offer through a Hire Purchase or Finance Lease.

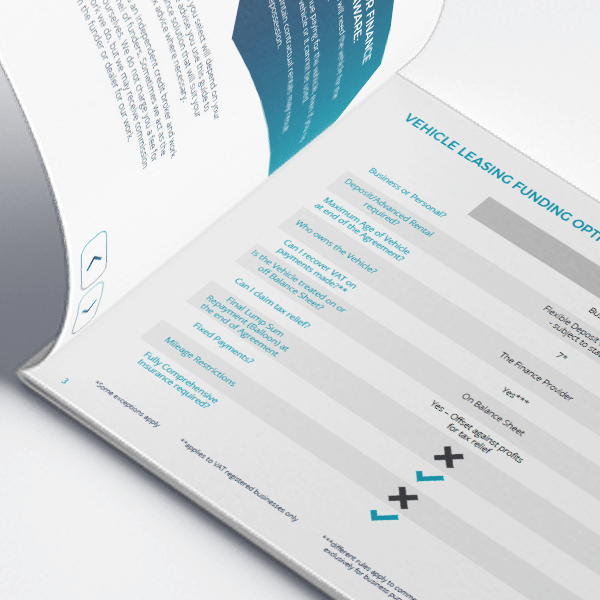

Finance Lease

Finance Lease

Shire Leasing buys your chosen vehicle on your behalf, leasing it back to you in exchange for agreed repayments over an agreed term. Your business will have use of the vehicle without any high upfront costs or mileage restrictions and rentals can be up to 100% tax deductible. At the end of the agreement, with our permission, the vehicle can be sold by you to a third party and you will receive 95% percentage of the sale proceeds. The VAT on both the grant and the interest paid by the Council will be payable together with your first regular rental repayment, but can be reclaimed in the normal course of business.

The benefits:

No major upfront costs – for just a small outlay you can use the vehicle immediately

Flexible repayment structure – rental payments can be tailored to match your cash flow

Tax advantages – Finance Lease rentals can be up to 100% tax deductible

No mileage restrictions – drive the vehicle without the worry of additional charges for exceeding mileage restrictions

Hire Purchase

Hire Purchase

A simple and straightforward way to pay for your vehicle. We hire the vehicle to you for an agreed period of time at an agreed repayment. You can gain ownership (title) by paying an ‘Option to Purchase fee’ of £150+VAT, provided that you have paid off all other sums due under the agreement. VAT on the balance financed is due along with your first rental but can be reclaimed in the normal course of business.

The benefits:

Ownership – the asset can be yours at the end of the agreement through a final nominal transfer of ownership fee provided all repayments are made

No major upfront costs – for just a small outlay you can use the vehicle immediately

Flexible repayment structure – rental payments can be tailored to match your cash flow

Tax advantages – the vehicle can be retained as a company asset on your balance sheet allowing some businesses to claim full capital allowances

No mileage restrictions – drive the vehicle without the worry of additional charges for exceeding mileage restrictions

A tree planted for every replacement vehicle

Through the scheme we will help improve the air quality in Bristol, making it an even better place to work, live and visit.

In addition, as part of our commitment to sustainability, for every customer that we support in financing a new vehicle we commit to planting a tree to support reforestation. A simple commitment with the aim of further improving the environment.

Complete your application

Please ensure you have all relevant information ready, including information about your business (proprietor/partners personal details if applicable), existing vehicle details and, if you have them, the replacement vehicle details (you can still continue with an application if you haven’t sourced your vehicle yet).

If your business meets Bristol City Council’s initial eligibility criteria, has been issued a Basic Eligibility Letter and you have decided which finance option is best for your requirements, you can continue with your application.

If you have any questions whilst completing this information, please do call us on 01827 211 712 and we will be happy to help.

Please be aware that our working hours are Monday to Thursday 09:00 to 17:30 and Friday 09:00 to 17:00. Applications will only be processed within these hours.

Answers to your frequently asked questions

Scheme

How do I register my interest for the financial assistance scheme?

If you are interested in participating in the scheme you should contact Bristol City Council in the first instance to discuss your circumstances. If you pass Bristol City Council’s initial eligibility checks, the Council will provide you with a Basic Eligibility Letter which you can pass on to the finance provider as evidence of your eligibility.

To start this process you should contact the Council’s Clean Air Team team by completing the form on their website.

Am I eligible for the financial assistance scheme?

You may be eligible for the scheme if you;

- Have chargeable, non-compliant vehicles that travel frequently into or around the zone, or if you operate from a premises within the zone.

- Based on DVLA records, the vehicle has been owned by the Applicant since the 5th November 2021.

- The vehicle is registered at DVLA to an address as defined by the scheme as an eligible post code.

- The vehicle has a current MOT.

- The vehicle is registered with the DVLA in the name of the Applicant.

- The vehicle will not have previously had financial support to upgrade to a compliant vehicle, retro fit or exemptions to this or any other CAZ.

All finance applications are subject to status, eligibility and credit checks.

Grant applications will be subject to eligibility checks.

Which businesses can you support?

We are able to support the following businesses which include;

- Limited Companies

- PLC’s

- Registered Charities

- Partnerships with more than three partners

- Sole Traders and Partnerships with less than 4 partners where;

- Hire Purchase – the balance being financed over the period of the agreement after applying the part exchange value, the Grant (if any) and any additional deposit paid by you against the Vehicle Price, is > £25,000.

- Finance Lease – the total of all repayments over the period of your lease including VAT is > £25,000. The repayments will be the repayments payable by you and shown on your finance documentation. These are based on the balance financed after applying the part exchange, the Grant (if any) and any additional deposit paid by you against the Vehicle Price has been deducted.

Our team will be happy to discuss these options with you.

How much will I pay when the CAZ goes live in Bristol?

The charge will be dependent on the type of vehicle you drive. Your vehicle type is listed on your V5C document, insurance and vehicle tax.

As a guide, charges will not apply to:

- Euro 4, 5 and 6 petrol vehicles, roughly 2006 upwards

- Euro 6 diesel vehicles, roughly end of 2015 onwards

- Fully electric vehicles and hydrogen fuel cell vehicles

- Modified or retrofitted vehicles registered with the Energy Saving Trust’s Clean Vehicle Retrofit Accreditation Scheme (CVRAS)

- Motorbikes

The following shows the daily charge by Bristol City Council for entering in the Clean Air Zone when it goes live:

- £9 per day private petrol and diesel cars, LGVs and taxis.

- £100 per day for coaches, buses and HGVs.

What should I do if I pass the eligibility test but you decline me for credit?

If you pass the eligibility assessment but fail our financial checks, we will let you know the reason why Shire are unable to proceed with your application. You can then apply to the other funders on the approved panel who may be able to support you. The funder’s details will be available on Bristol City Council’s website or in your Basic Eligibility Letter.

Alternatively, if you have passed eligibility checks, you will be able to proceed with a Grant-only application.

Finance

What financial support is available under the financial assistance scheme?

The financial support scheme provides grants and interest-subsidised finance to help those businesses who may regularly have to pay charges for journeys into Bristol’s new Clean Air Zone.

Subject to status, eligibility and credit checks, we are able to offer you the following options;

- Grant only and acquiring your new vehicle with cash/your own financing

- Grant and a subsidised finance agreement.

What financial products do you offer?

Our financial products, available over terms of 2 – 5 years (6 and 7 years for coaches and buses) are;

Hire Purchase – this allows you to spread the cost of the vehicle with the option to own it at the end of the fixed period for a one off Purchase Option Fee of £150+VAT or,

Finance Lease – if you are looking for a tax-efficient solution, this product allows you to offset monthly/quarterly payments against taxable profits but where you can receive 95% of the proceeds of sale at the end of lease term.

You can find out more about financial options here.

How does the subsidised Financing work?

Subject to eligibility and credit checks you will be able to spread the cost of acquiring your eligible replacement vehicle over a period of up to 5 years (6 and 7 years available for Coaches).

The balance to finance is calculated by deducting the trade-in value and full Grant from the replacement vehicle cost. We then spread this cost over the funding period, with reduced finance charges as these are subsidised by Bristol City Council. This will result in lower monthly or quarterly payments for the duration of the Finance Agreement.

The level of support will depend on the specifics of your upgrade. We look forward to discussing this with you and will always set out these figures in a simple quotation which shows the level of subsidy available for your vehicle upgrade.

Do you offer a Contract Hire option?

We do not offer a contract hire agreement but if this is something that you are interested in, this option may be available from the other panel of funders whose details are on the Bristol Clean Air Zone website.

What lease repayment periods are available?

The maximum repayment period for the interest-free finance will be 5 years, which may be extended to 6 or 7 years for some specialist vehicles, including buses and coaches.

Sometimes the repayment period may be restricted when we confirm approval of your credit/eligibility checks but this will be communicated to you with the decision on your application.

What is the value of the Grants available?

You could receive a Grant of up to 35% of the upgrade cost, significantly reducing the financial impact of upgrading your non-compliant vehicle. These Grants can be used alongside the subsidised finance. Grants are capped for each vehicle type, as shown below.

- Vans or LGVs: up to £4,500.00

- Taxi PHVs: up to £1,500.00

- Taxi Hackneys: up to £4,000.00

- Coaches and HGVs: up to £16,000.00

How are rental repayments made on the finance agreement?

All rental repayments are payable by direct debit mandate which will be part of the documentation that you are provided with to sign if your application is approved and you decide to proceed.

Existing vehicle (s)

Where can I check if my vehicle is non-compliant?

The GOV.UK vehicle checker service will tell you whether you will have to pay a daily charge to drive your vehicle in any clean air zone in England.

You can access this on www.gov.uk/check-clean-air-zone-charge. You will need your vehicle registration number.

You might need to pay, if your vehicle does not meet emissions standards.

Can I use the scheme to add new vehicles to my existing fleet?

No. The scheme cannot be used for adding vehicles to your fleet only for the replacement of eligible non-compliant vehicles.

Can I use the scheme to retrofit an existing vehicle?

Subject to eligibility and checks, we are able to provide finance to retrofit or re-power existing non-compliant vehicles, or to replace a non-compliant vehicle with a different type or size of vehicle. Grants for retrofitting are capped for each vehicle type, as shown below.

- Coaches and HGVs: up to £16,000.00

Replacement vehicle (s)

Which vehicles are compliant?

Vehicles that are electric, low emission or conform to more recent Euro standards should emit less pollution than older vehicles, and can therefore travel without charge in Bristol Clean Air Zone. The following classes of vehicles are all compliant:

- Euro 6/VI diesel vehicles (or newer)

- Euro 4/IV petrol vehicles (or newer)

- Fully electric vehicles and hydrogen fuel cell vehicles

- All hybrid vehicles

- Modified or retrofitted vehicles registered with the Energy Saving Trust’s Clean Vehicle Retrofit Accreditation Scheme (CVRAS)

Which vehicles are non-compliant?

Vehicles that fail to meet Bristol’s emission standards we call ‘non-compliant’. These vehicles, including non-UK vehicles, will be charged if driving in Bristol’s Clean Air Zone.

The following classes of vehicles are non-compliant:

- Pre Euro 6/VI diesel vehicles (this means Euro 1 to 5/IV or earlier)

- Pre Euro 4/IV petrol vehicles (this means Euro 1 to 3 or earlier)

Are there any restrictions on the choice of dealer supplying the new vehicle?

The vehicle must be sourced from a dealer registered with the Retail Motor Industry Federation or other reputable trade association, or in the case of a retrofit, from a Clean Vehicle Retrofit Accreditation Scheme certified manufacturer or dealer.

The dealership needs to be approved by Shire Leasing and must have a physical forecourt.

What do I do if I haven’t yet sourced my new vehicle?

Provided that you have your Basic Eligibility Letter from Bristol City Council confirming your eligibility, we can complete eligibility and credit checks (where applicable) that will be conditional on you sourcing your vehicle. Once you have decided on the vehicle and dealership you should provide us with the information so that we can complete our final checks and provide approval for you to proceed.

You will need to acquire your replacement vehicle, or place the order for the replacement vehicle, before the expiry of your eligibility letter.

What are the rules for the new vehicle selection?

If you are eligible and pass the credit checks, you can use the funds to reduce the cost of any of the following:

- Replacing existing non-compliant vehicles with new or second-hand vehicles which meet Bristol City Council’s emissions standards

- Retrofitting or re-powering existing or replacement non-compliant vehicles so that they meet Bristol City Council’s emissions standards.

Any replacement vehicles must be a similar make or model to your existing vehicle, but must be compliant with Bristol City Council’s emissions standards.

Post-application

What happens at the end of the finance agreement?

We have two financial products available to you and the end of term treatment will be different for each. Providing that all rentals due on the agreement have been paid, your options will be;

Hire Purchase – you can own the vehicle at the end of the fixed period for a one off Purchase Option Fee of £150+VAT (providing all payments have been made) or,

Finance Lease – if you are looking for a tax-efficient solution, allowing you to offset monthly payments against taxable profits (where eligible). Your end of term options will be;

- Continue to hire the agreement for an annual peppercorn rental

- Sell the vehicle on our behalf and retain 95% of the sale proceeds

Will I need to repay the Grant and/or interest on my financing agreement?

Provided that you do not breach the terms of the Grant and/or the subsidised interest financing agreement you will not be required to repay the financial support provided by Bristol City Council. If you do breach the terms of the Grant and/or subsidised interest financing award, you may be liable to repay the Grant and the interest amount provided by Bristol City Council in full or in part (terms apply).

The terms of the scheme require that the new vehicle must remain in the same ownership (or remain financed under the associated finance agreement) and taxed with the DVLA for at least 24 months from the purchase date and must continue to be used by the owner for the purpose stated in the application. Please refer to Bristol City Council’s Clean Air Zone Financial Assistance Scheme for full terms and conditions.

Useful links and contacts

Is there any way that I can find out more?

- To check if your vehicle will be charged in Bristol’s CAZ and other clean air zones in England, go to gov.uk/check-clean-air-zone-charge. You will need your vehicle’s registration number.

- For questions about the vehicle checker’s result, your vehicle’s euro standard or compliance, contact the Central CAZ Support Service using the web form at gov.uk/cleanairzone or call 0300 029 8888.

- To learn more about the Bristol Clean Air Zone, visit www.bristol.gov.uk/residents/streets-travel/bristols-caz

Talk to one of our team

If you haven’t been able to find the answer to your question or need further support for your application, our award-winning team at Shire Leasing would be more than happy to help.

Simply complete our enquiry form and a member of our team will be in contact with you as soon as they can.

Please be aware that our working hours are Monday to Thursday 09:00 to 17:30 and Friday 09:00 to 17:00. Enquiries will only be processed within these hours.